Capstone: Time-series & ML

ML

Time-Series

Python

Webscraping

APIs

Forecasting time-series trends with classical models and deep learning.

Problem

Built a forecasting pipeline to predict future metrics for a stock price changes.

Data

Combined multiple data sources from macroeconomic, microeconomic, historical stock price, and sentiment data. Webscraping and APIs were used to gather these

Approach

- Cleaned and merged time-series

- Explored patterns and seasonality

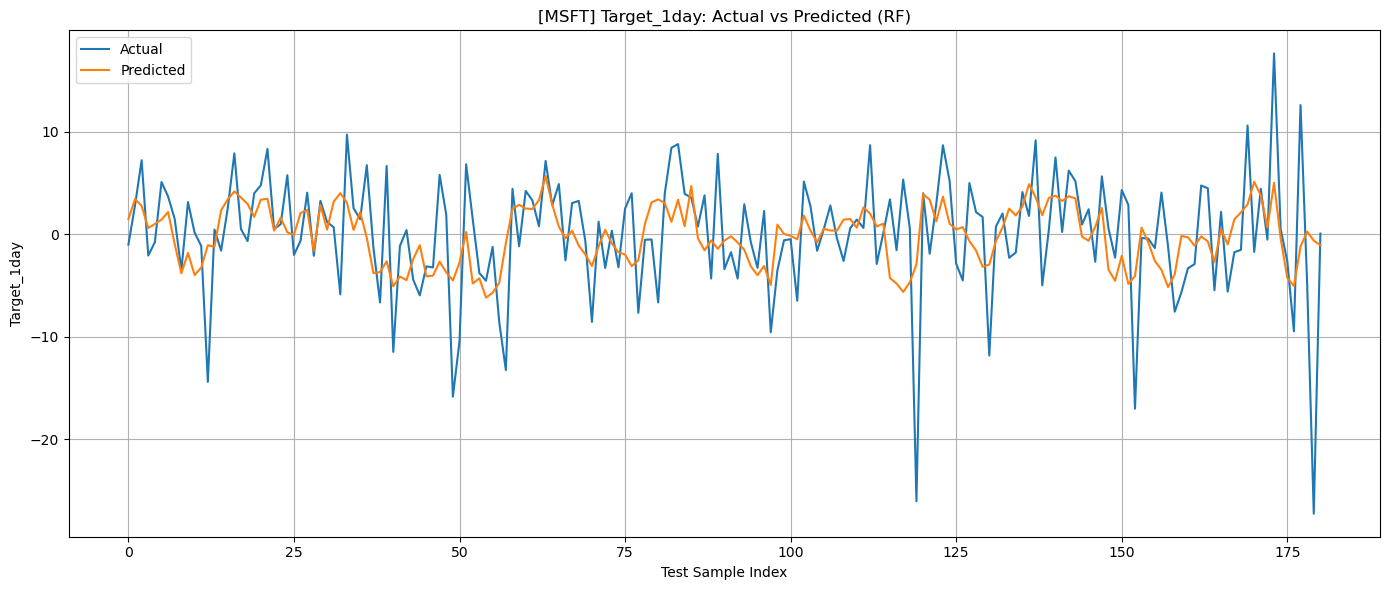

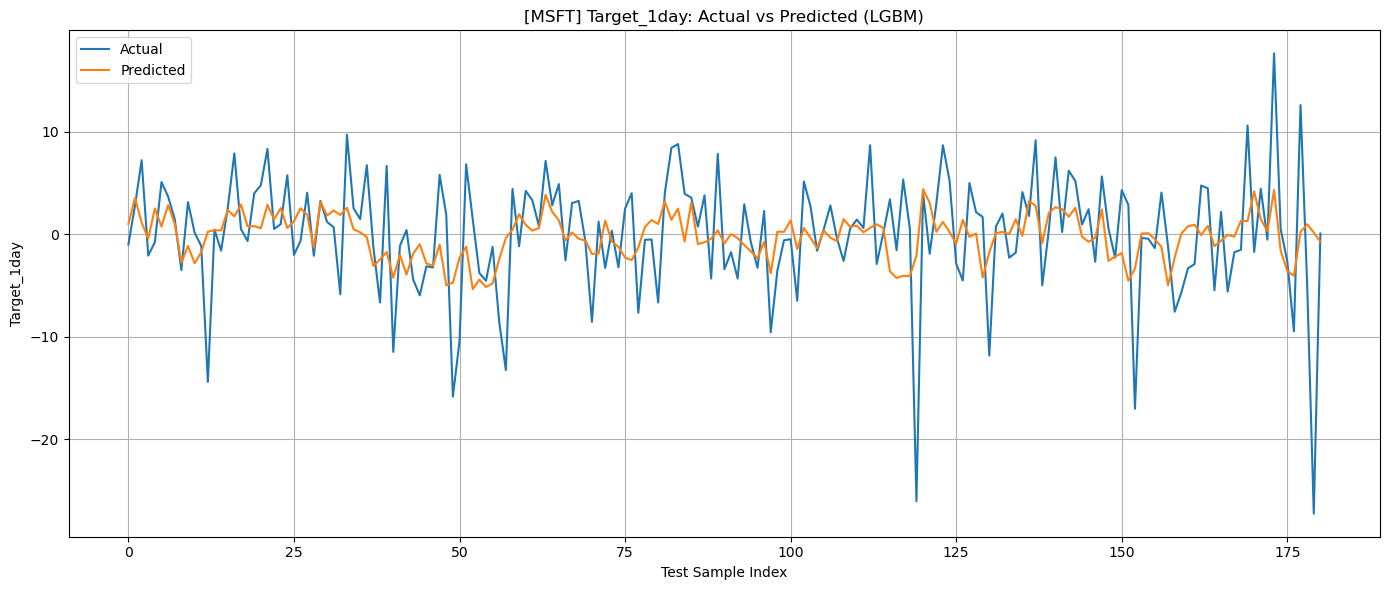

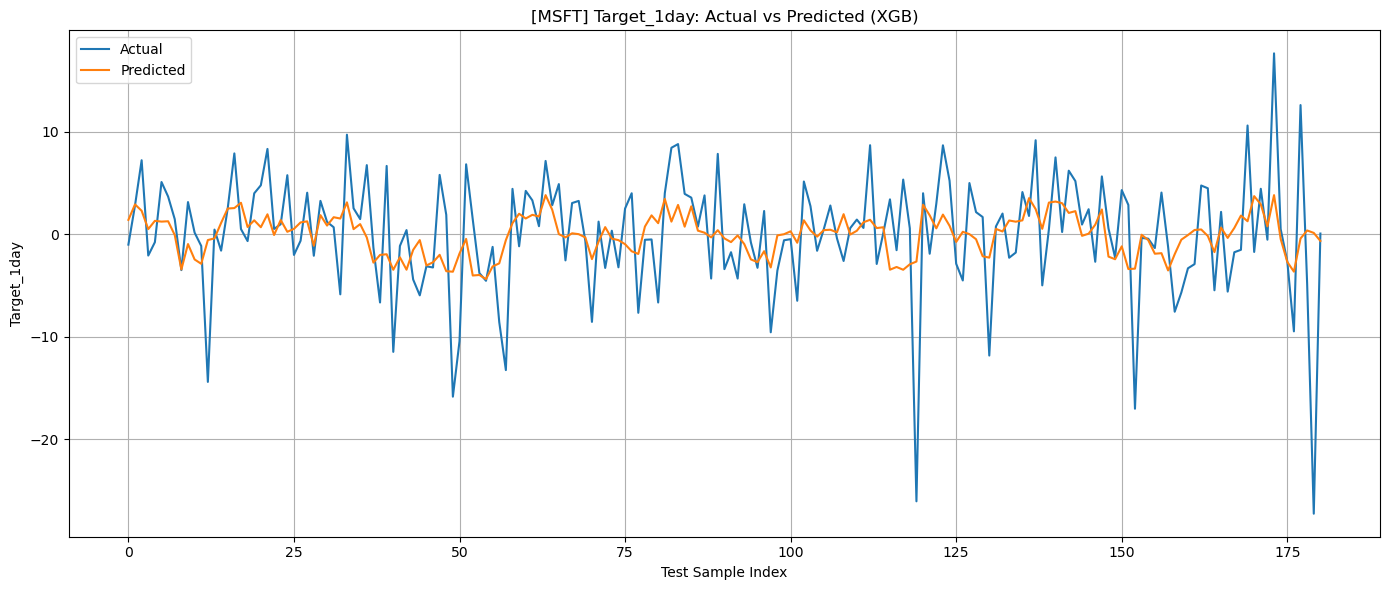

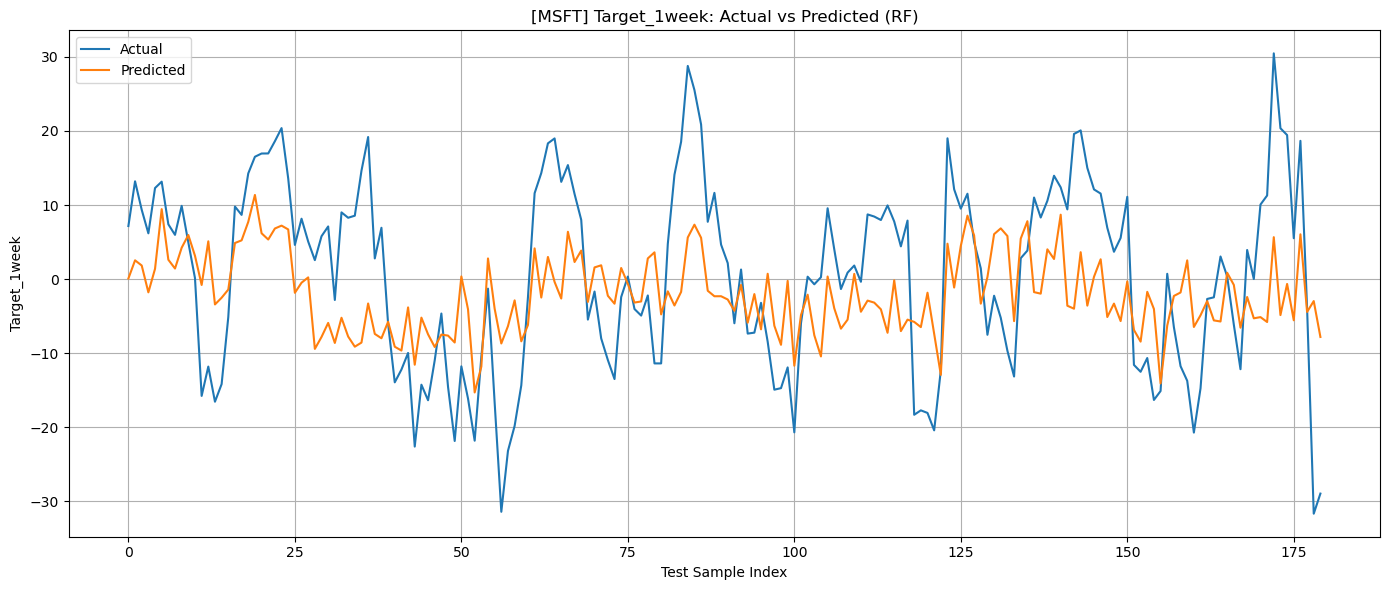

- Trained RandomForest, TFT, and LSTM models

Results

The RandomForest model was the most accurate but not accurate enough when it comes to yearly predictions

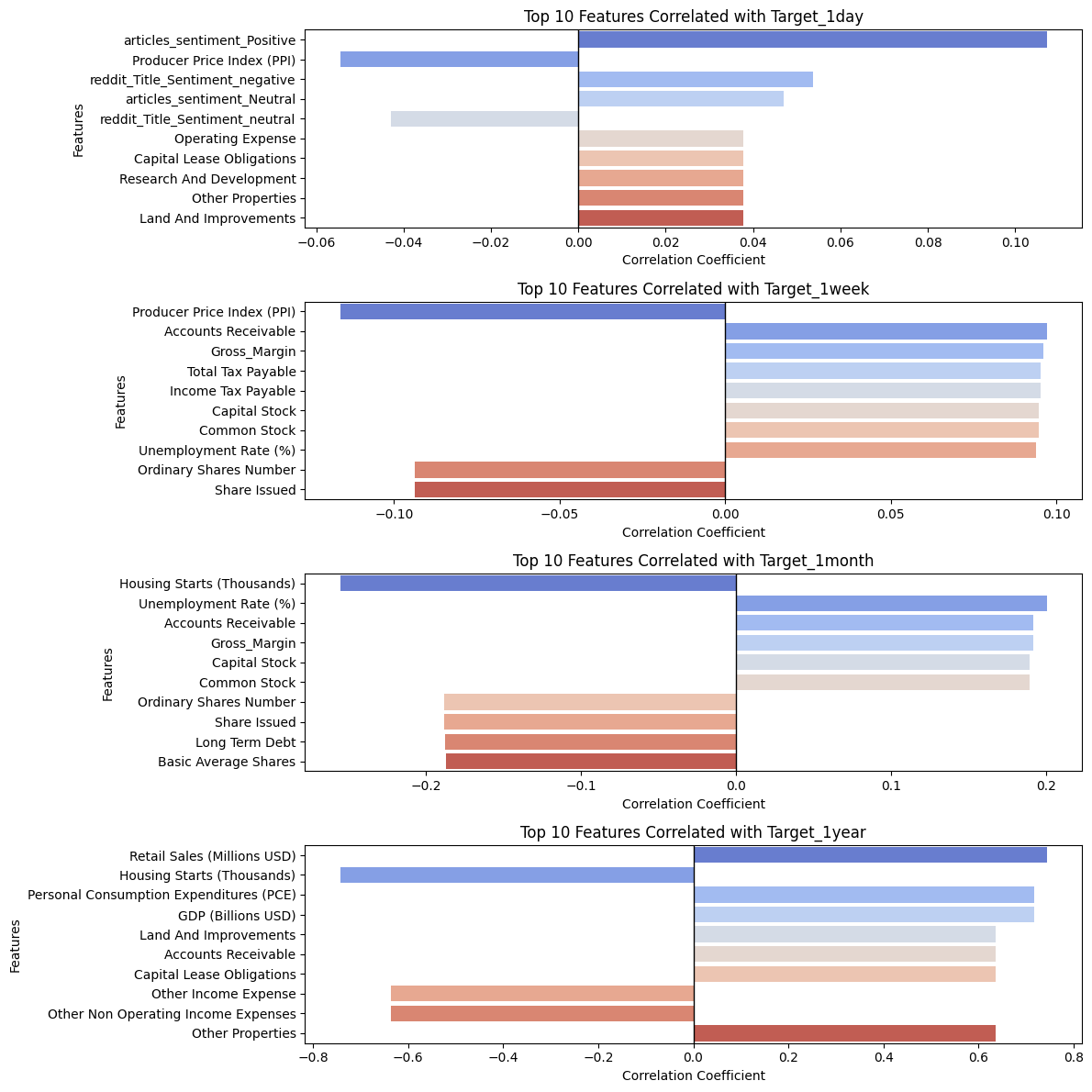

Top Correlations by Horizon

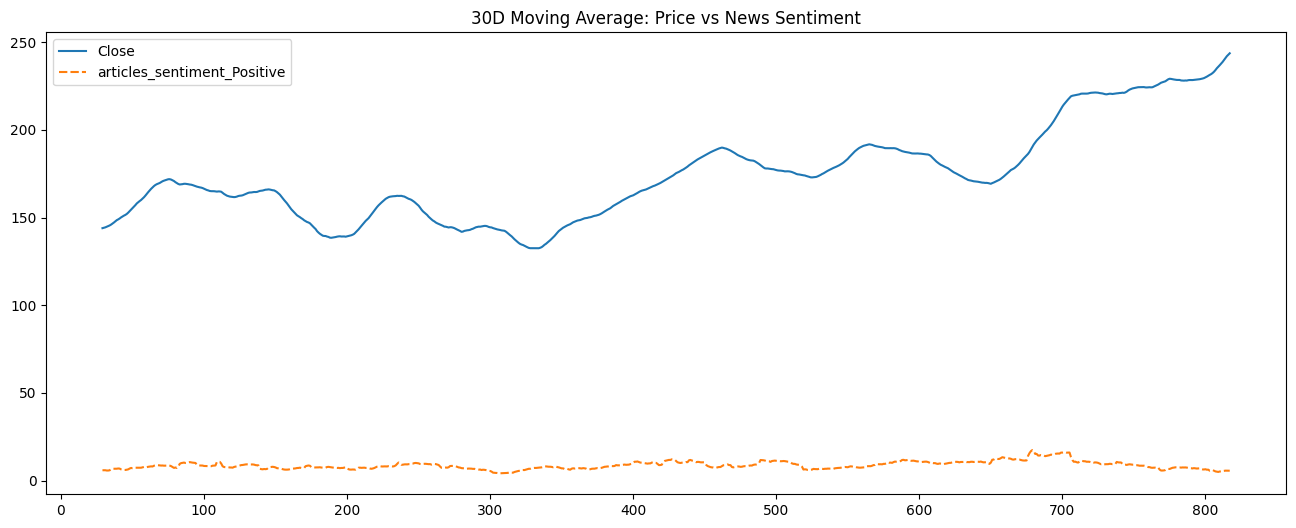

30‑Day MA: Price vs Positive News Sentiment

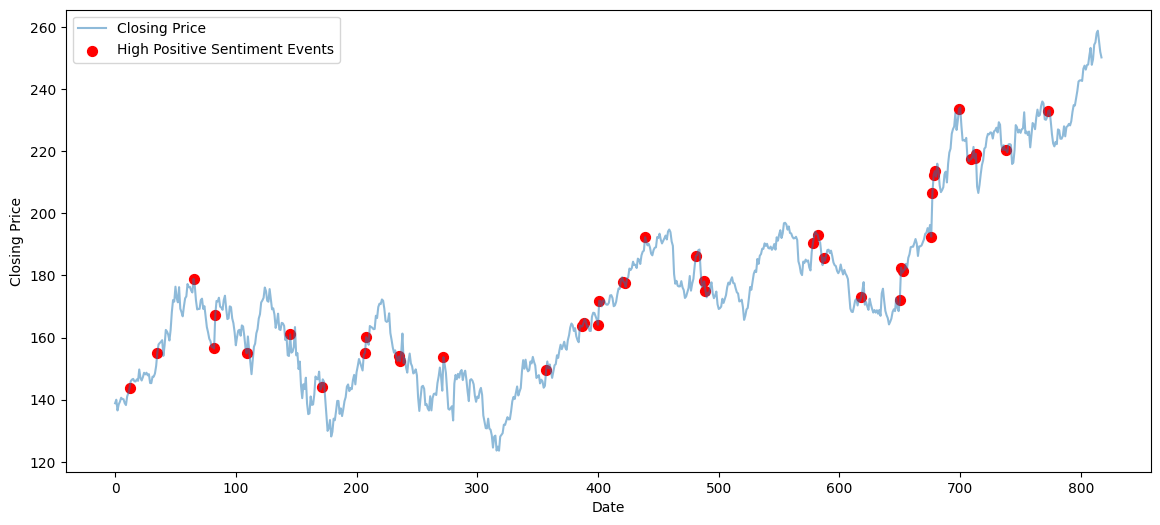

High Positive Sentiment Events on Price

1‑Day Ahead: Actual vs Predicted (Random Forest)

1‑Day Ahead: Actual vs Predicted (LightGBM)

1‑Day Ahead: Actual vs Predicted (XGBoost)

1‑Week Ahead: Actual vs Predicted (Random Forest)

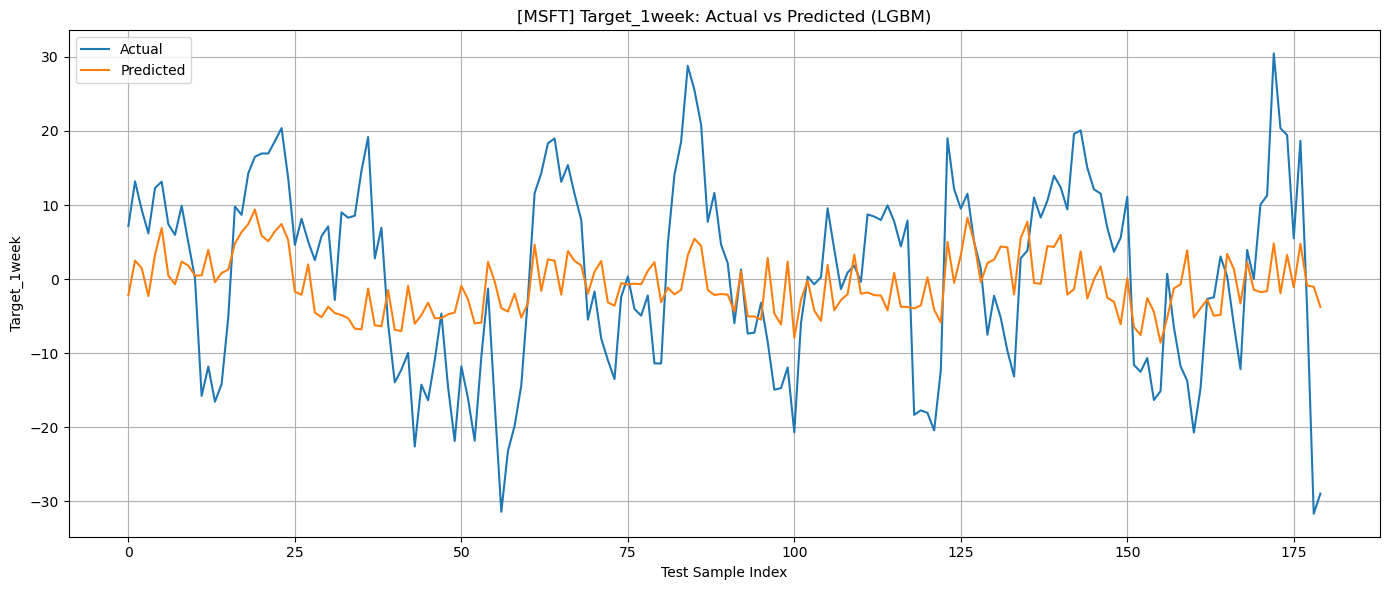

1‑Week Ahead: Actual vs Predicted (LightGBM)

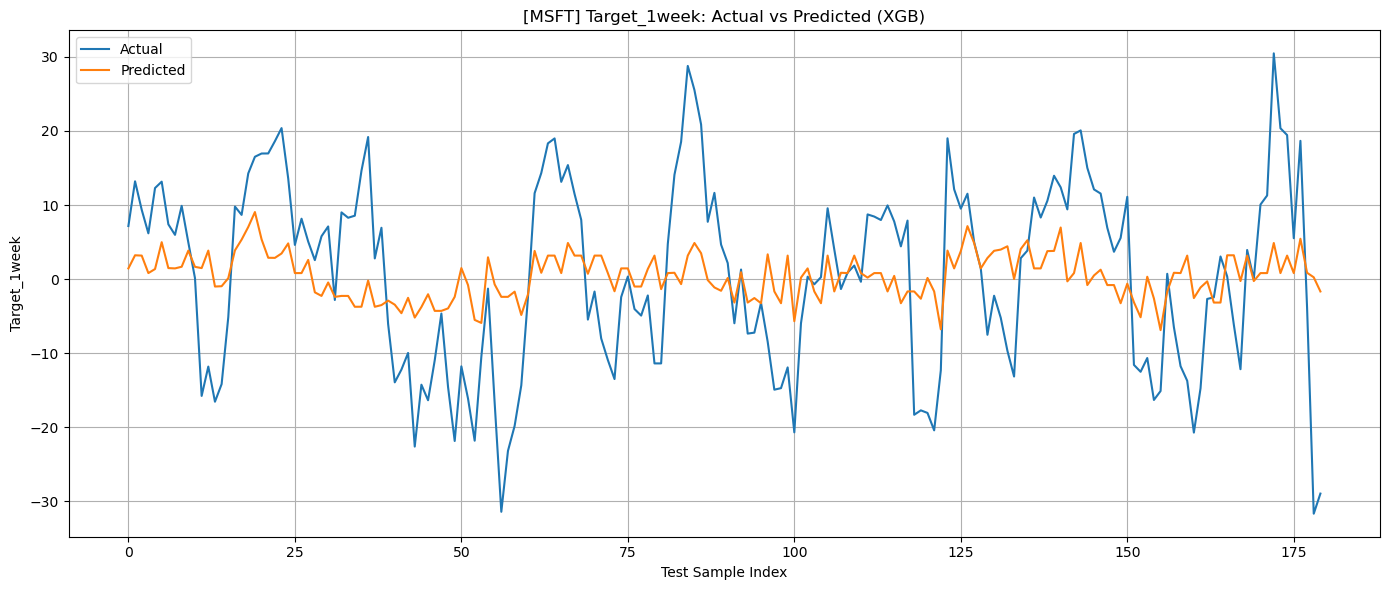

1‑Week Ahead: Actual vs Predicted (XGBoost)